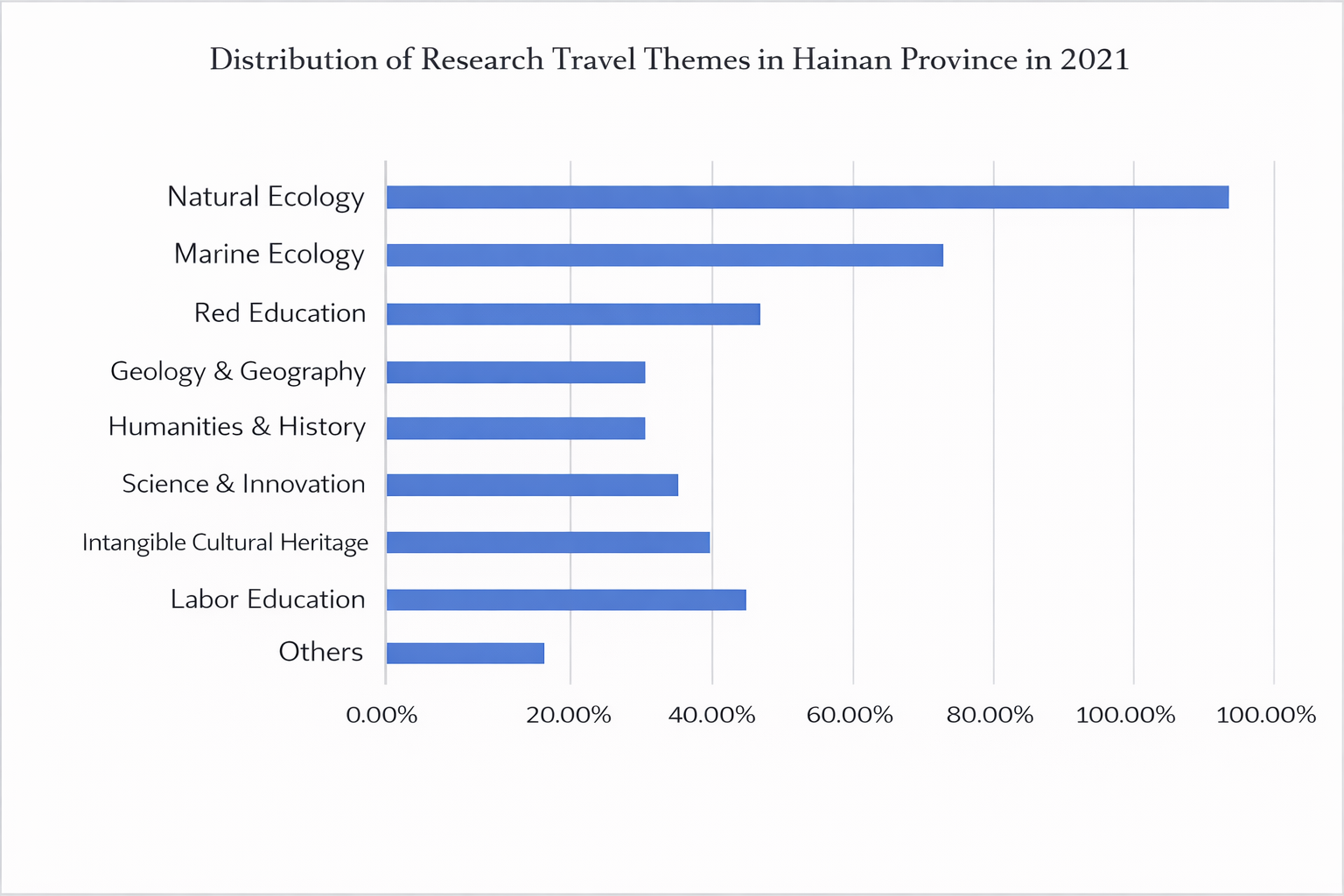

Against the backdrop of the integration of study tours and quality-oriented education, Sanya has emerged as a key region for promoting the development of golf study tours, leveraging its favorable climate, industry foundation, and tourism resources. This study positions policy support as the core driver and employs literature review, field investigation, and the RMP-SWOT framework to explore strategies for developing golf study tour products in Sanya. While policy guidance has accelerated the growth of golf study tours, challenges remain, including product homogenization, weak course systems, and insufficient teaching staff. The RMP-SWOT analysis reveals that Sanya’s advantages include suitable climate, high-quality golf facilities, and abundant tourism resources, whereas weaknesses lie in limited market awareness, inadequate supporting services, and homogeneous competition. Opportunities stem from policy incentives and rising consumer demand, while threats arise from macroeconomic fluctuations and regional competition. Targeted development strategies are proposed: establish a tiered course system offering “skills + literacy” courses for youth and “sports + leisure” products for parent-child groups; create a school-enterprise cooperative teacher training and certification system to address staffing gaps; adopt an “online precision marketing + offline experiential engagement” model, leveraging Sanya’s tourism IP to enhance brand influence. Sanya should orient itself toward “sports education,” optimize training systems, modular course design, and integrated marketing to significantly enhance product competitiveness. This will facilitate the effective translation of policy advantages into implementation, integrate resources to drive product iteration, and form a distinctive industry framework. Future research could focus on intelligent courses, sustainable development, and cross-regional collaboration to support industry standardization.