About JAEPSJournal of Applied Economics and Policy Studies (JAEPS) is an open-access, peer-reviewed academic journal hosted by Peking University Research Centre for Market Economy (RCME) and published by EWA Publishing. JAEPS is published monthly. JAEPS present latest theoretical and methodological discussions to bear on the scholarly works covering economics, management and finance & accounting, as well as multifaceted issues arising out of emerging concerns from different industries and debates surrounding latest policies. Situated at the forefront of the interdisciplinary fields of applied economics and policy studies, this journal seeks to bring together the scholarly insights centering on economics, and relevant subfields that trace to the discipline of management, finance & accounting, and interdisciplinary fields the aforementioned. JAEPS is dedicated to the gathering of intellectual views by scholars and policymakers. The articles included are relevant for scholars, policymakers, and students of economics, policy studies, and otherwise interdisciplinary programs.For more details of the JAEPS scope, please refer to the Aim&Scope page. For more information about the journal, please refer to the FAQ page or contact info@ewapublishing.org. |

| Aims & scope of JAEPS are: ·Economics ·Management ·Finance & Accounting ·Interdisciplinary Fields |

Article processing charge

A one-time Article Processing Charge (APC) of 450 USD (US Dollars) applies to papers accepted after peer review. excluding taxes.

Open access policy

This is an open access journal which means that all content is freely available without charge to the user or his/her institution. (CC BY 4.0 license).

Your rights

These licenses afford authors copyright while enabling the public to reuse and adapt the content.

Peer-review process

Our blind and multi-reviewer process ensures that all articles are rigorously evaluated based on their intellectual merit and contribution to the field.

Editors View full editorial board

Beijing, China

xqin@pku.edu.cn

London, UK

canh.dang@kcl.ac.uk

Edinburgh, UK

B.Adamolekun@napier.ac.uk

Murcia, Spain

faura@um.es

Latest articles View all articles

With the gradual deterioration of global environmental problems, green finance has gradually become an important means to promote sustainable economic development. This paper aims to explore the impact of green finance on regional economic development, and analyze how it promotes the green transformation and upgrading of regional economy through such approaches as optimization of capital allocation, policy guidance and support. Through literature review and comparative study, it is found that green finance can not only guide capital to flow into the environmental protection industry and promote the R&D and application of green technologies, but also optimize the regional industrial structure, improve resource utilization efficiency and reduce environmental pollution. However, the development of green finance still faces many challenges, such as policy matching and information disclosure. To give full play to the role of green finance in regional economic development, it is necessary to strengthen policy guidance, improve the legal system, enhance international cooperation, and raise the awareness and capability of financial institutions in green investment. This paper provides a comprehensive overview of how green finance affects regional economic development, discusses the regional differences in the relationship between green finance and regional economic development through comparative analysis of data from four regions, and offers valuable insights for policymakers and financial institutions through in-depth research on this topic, so as to promote more sustainable economic development.

View pdf

View pdf

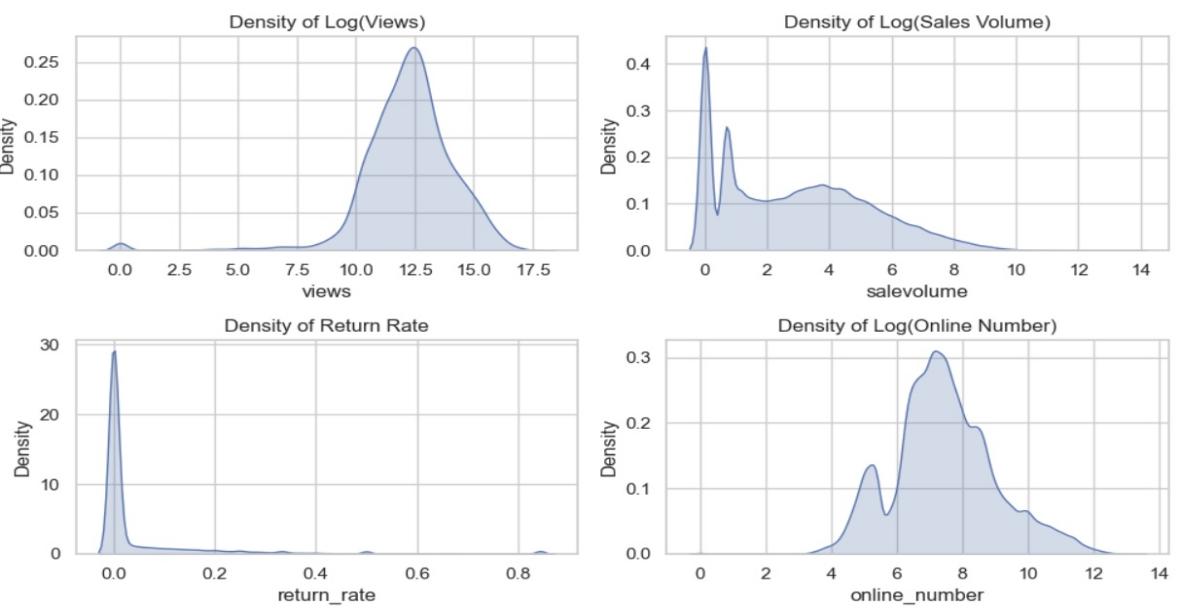

Livestream e-commerce enables continuous consumer engagement across the day, yet the role of time-of-day in shaping consumer behavior remains underexplored. This study examines whether shopping during nighttime hours is associated with differences in impulsive engagement, post-purchase outcomes, and consumer retention. Using 982,746 session-level observations from Douyin livestream commerce, we compare consumer behavior during a daytime alertness window (10:00–18:00) and a nighttime low-alertness window (22:00–06:00). Descriptive analyses, Welch’s t-tests, and multivariate regression models are employed to evaluate circadian differences across engagement, sales, return behavior, and retention-related measures. Results show that nighttime livestream sessions generate significantly higher impulsive engagement and sales volume but are associated with lower retention and engagement stability. In contrast, return rates do not increase meaningfully for nighttime purchases once economic and contextual controls are introduced, indicating that heightened impulsivity does not translate into higher regret-driven returns. These findings suggest that time-of-day systematically shapes both short-term commercial performance and longer-term engagement outcomes in livestream commerce. By introducing circadian timing as an explanatory dimension, this study extends applied economic analyses of digital markets and offers implications for platform strategy, performance evaluation, and time-sensitive policy considerations in 24-hour online retail environments.

View pdf

View pdf

This research explored the factors that determine housing prices and their regional differences in Beijing's second-hand housing market using complete transaction data from 2024 covering all 16 administrative areas, adopted the Hedonic Price Model and carried out separate Ordinary Least Squares (OLS) regressions for different sub-markets, the results showed a clear two-part difference in how prices were formed which was described as being "resource-driven" compared to "residence-driven", in central urban areas, housing prices were mainly influenced by proximity to top-quality public resources and there was a large price increase for apartments having three or more bedrooms, on the other hand, in suburban zones, market evaluations concentrated more on fundamental living features showing a definite preference for south-facing directions and medium to large sized units, moreover, the additional impacts of important structural elements varied significantly among these regions, the discoveries offered strong empirical proof to back location-specific regulatory measures for the existing housing supply in mega-cities such as Beijing and also provided useful information for market players including house buyers, builders and policymakers enabling them to make better-informed decisions in line with the main value influences in each market section.

View pdf

View pdf

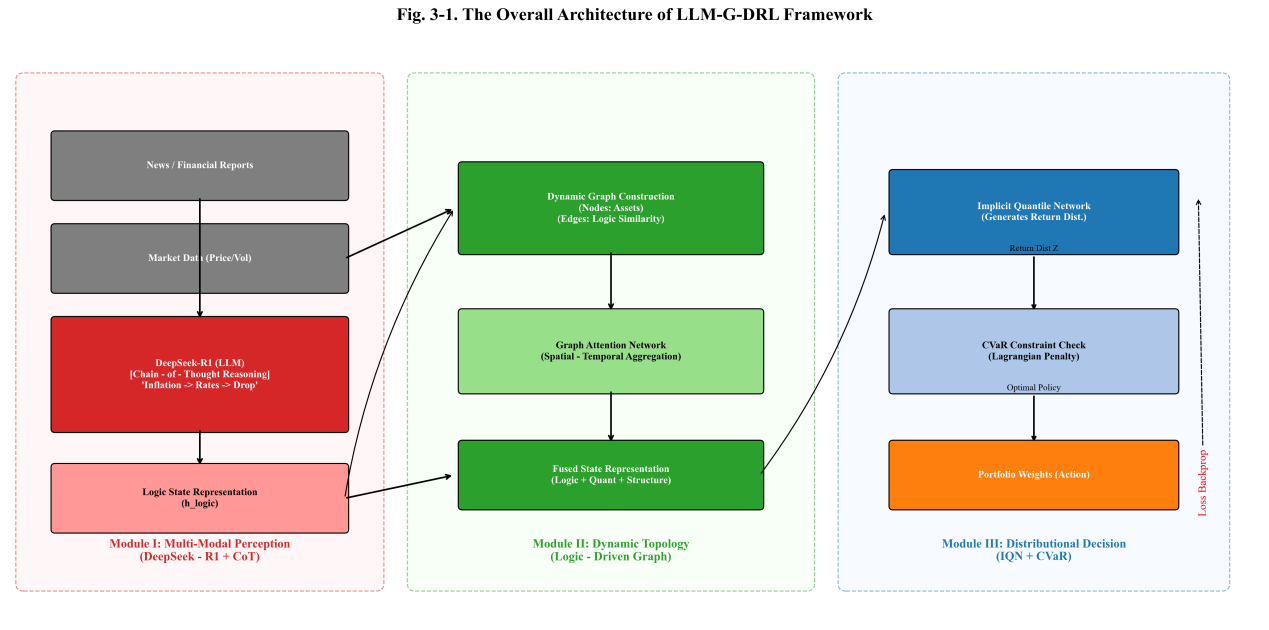

Time series of financial asset returns typically exhibit pronounced non-ergodicity and heavy-tailed, spiky distributions. Traditional mean–variance models and expectation-based Deep Reinforcement Learning (DRL) approaches struggle to effectively capture distributional shifts induced by exogenous logical shocks. To address this challenge, this paper proposes a risk-constrained distributional reinforcement learning framework that integrates large language model–based logical reasoning with dynamic graph dependencies (LLM-G-DRL). At the perception level, rather than relying on conventional sentiment polarity classification, this study introduces large language models that support Chain-of-Thought (CoT) reasoning (e.g., DeepSeek-R1) to construct a Bayesian logical belief updating mechanism. This mechanism maps unstructured financial texts into high-dimensional latent logical states embedding causal transmission paths, thereby correcting predictive biases arising from exclusive dependence on historical price and volume data. At the structural level, to characterize the nonlinear contagion of systemic risk, the framework abandons the assumption of static adjacency matrices and employs dynamic graph attention networks (Dynamic GAT) to reconstruct time-varying topological dependencies among assets, enabling explicit modeling of risk propagation channels. At the decision-making level, the portfolio optimization problem is formulated as a Constrained Markov Decision Process (CMDP). Implicit Quantile Networks (IQN) are adopted to approximate the full probability distribution function while preserving higher-order moment information. Furthermore, based on Lagrangian duality theory, a hard constraint on Conditional Value at Risk (CVaR) is introduced, transforming tail-risk control into a dynamic penalty mechanism governed by dual variables. Theoretical analysis demonstrates that, through a closed-loop design combining “logical priors, structural contagion, and distributional decision-making,” the proposed framework exhibits stronger mathematical robustness than traditional point-estimation models. It effectively identifies and avoids tail losses under extreme market conditions, offering a statistically interpretable new paradigm for intelligent asset allocation in non-stationary markets.

View pdf

View pdf

Volumes View all volumes

Announcements View all announcements

Journal of Applied Economics and Policy Studies

We pledge to our journal community:

We're committed: we put diversity and inclusion at the heart of our activities...

Journal of Applied Economics and Policy Studies

The statements, opinions and data contained in the journal Journal of Applied Economics and Policy Studies (JAEPS) are solely those of the individual authors and contributors...

Indexing

The published articles will be submitted to following databases below: